salt tax deduction news

Speaking at a news conference regarding the State and Local Taxes SALT Caucus outside of Washington DC. On April 15 2021 the Capitol will be dedicated.

Salt Tax Deduction 11 Million Taxpayers Taking A Hit From New Tax Law Deduction Tax Deductions Tax Refund

Dems just snuck a tax cut for the rich into.

. What Is The Maximum Salt Deduction For 2021. December 12 2021 930 AM 4 min read. A Democratic proposal aims to restore the SALT deduction for taxpayers who make less than 400000 a year.

52 rows Like the standard deduction the SALT deduction lowers your adjusted gross income AGI. Republicans established the 10000 cap on the SALT deduction in an effort to raise revenue to help offset the cost of tax cuts elsewhere in their 2017 law - which reduced the corporate tax rate from 35 percent to 21 percent and also lowered individual income tax rates. The SALT deduction is a tax break for high-earning individuals who indulge the progressive big-spending plans of state and local officials in states including California.

Tom Malinowski D-NJ told The Hill earlier this week. The so-called SALT tax cap imposed a 10000 limit on IRS deductions for state and local taxes like income and capital gains levies and property taxes. Meanwhile in districts like mine.

Paying a state income tax of 10 percent or more. Senate Democrats have instead floated gradually eliminating the SALT deduction for people who make about 400000 or more. State Local Tax SALT The IRSs clarification in 2020 that partnerships and S corporations may deduct their state and local tax SALT payments at the entity level in computing their nonseparately stated taxable income or loss was welcomed by taxpayers and their advisers.

In tax years 2018 to 2025 the SALT deduction is capped at 10000 for single taxpayers 10000 for married couples filing jointly and 5000 for. Erin Cleavenger The Dominion Post Morgantown WVa. Republicans had slashed the SALT deduction to 10000 in their 2017 tax cut bill a move that some Democrats derided as a partisan revenge mission against high-tax blue states like New York New.

A rollback of the cap on the state and local tax SALT deduction is on ice after Sen. Connecticut and New York have revived their efforts to overturn the SALT cap the federal deduction for state and local taxes that. New York Daily News Nov 05 2021 at 1114 AM.

Americans who rely on the state and local tax SALT deduction at tax time may be in luck. Congressional Democrats are negotiating changes to the 10000 cap on the federal deduction for state and local taxes known as SALT. That was bad news for top earners in blue states such as California and New York.

But the Tax Cuts and Jobs Act limited that deduction to 10000. As Congress struggles to pass the Build Back Better bill some congressional Democrats are exploring new proposals to raise the 10000 cap on the state and local tax SALT deduction. However nearly 20 states now offer a workaround that allows.

By 2030 the cap on the federal deduction for state and local taxes known as SALT will. Many Democrats have sought to raise the cap ever since President Donald Trump limited the write off to 10000 in. A Democratic proposal aims to restore the SALT deduction for taxpayers who make less than 400000 a year and increase the deduction cap for Americans who make up to 1 million.

After all partners or shareholders might otherwise have to reckon with the Sec. 12There has been a lot of discussion amongst government leaders about the cap on state and local. Democrats have forged a compromise to partially lift the so-called SALT tax deduction cap that hit the New York metro area particularly hard.

There are 1 in the bank for House Democrats. The Supporting Americans with Lower Taxes SALT Act sponsored by US. Senate Democrats remain divided over the SALT tax deduction in President Joe Bidens economic agenda with some looking to scale back the expansion to 80000 passed by the House.

There are people who may make more. Psaki wont rule out tax cuts for wealthy despite Sanders SALT demand Bidens Build Back bill is in worse shape than ever hooray. Americans who rely on the state and local tax SALT deduction at tax time may be in luck.

Joe Manchin D-WVa raised broader objections to President Bidens social spending and climate package. The SALT deduction is valuable in high-tax areas in the Northeast and West Coast. Income limits are tricky in part because there are very wealthy people who dont have a lot of income Rep.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

The Buried Boon To The Wealthy In The Democrats Tax Plan The Economist

Real Estate Investing News Advice Biggerpockets Blog Tax Help Estate Tax Income Tax

The Property Tax Deduction Will Remain In The U S House Tax Reform Bill Ways And Means Committee Chairman Kevin Brady Tax Deductions Higher Income Income Tax

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

Left Wants To Give Wealthy Constituents Bigger Salt Deduction

What Is A Tax Deduction Tax Deductions Deduction Tax

Congressman Mike Garcia Introduces Bill To Repeal State Local Tax Deduction Cap

U S Lawmakers Pepper Congress With Pleas For Salt Tax Break Florida Phoenix

Salt Here S How Lawmakers Could Alter Key Contentious Tax Rule

House Raises Salt Tax Deduction Cap From 10k To 80k In Build Back Better Senate Plans Changes So Millionaires Won T Get Tax Cut Yonkers Times

The Impact Of Eliminating The State And Local Tax Deduction Report

Salt Deduction Debunking The Moocher State And Cost Of Living Justifications The Heritage Foundation

Who Can Take The New Business Tax Deduction Even Tax Experts Aren T Sure Utica New York Emotional Wellness National Sleep Foundation

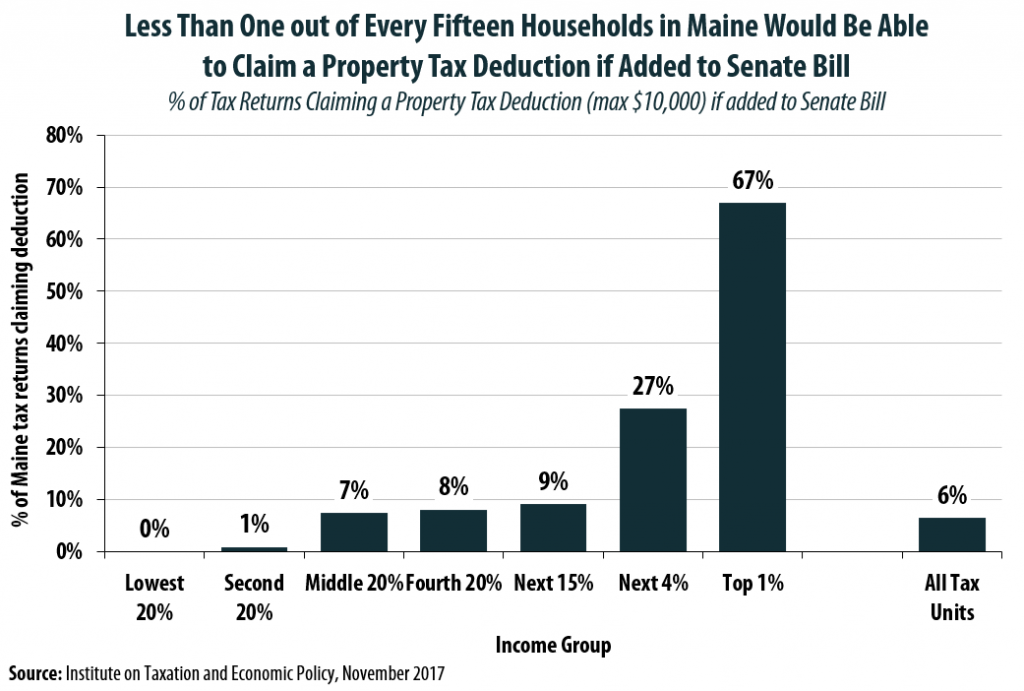

Senator Collins Pushes Hard For A Property Tax Deduction That Very Few Of Her Constituents Will Be Able To Claim Itep

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Usa Real Estate Agents Are You Claiming All Your Expenses Free Handy Tax Deduction Checklist And Cheat She Real Estate Agent Tax Deductions Real Estate Tips

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It